cumulative preferred stock meaning

Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. They have precedence over common dividends which cannot be paid as long as a cumulative preferred obligation exists.

Preference Shares Financiopedia

Cumulative preferred stock can receive the dividend even before the stockholders receive their payment.

. Type of preferred stocks that has a provision for payment of all dividends by the company. Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid. If the dividends arent declared or paid the stock can accumulate the unpaid dividends for a future date when they are declared.

If a company misses a dividend payment for any reason it still owes it to cumulative preferred stockholders. It provides a right to claim dividends of the. Definition of Preferred Stock.

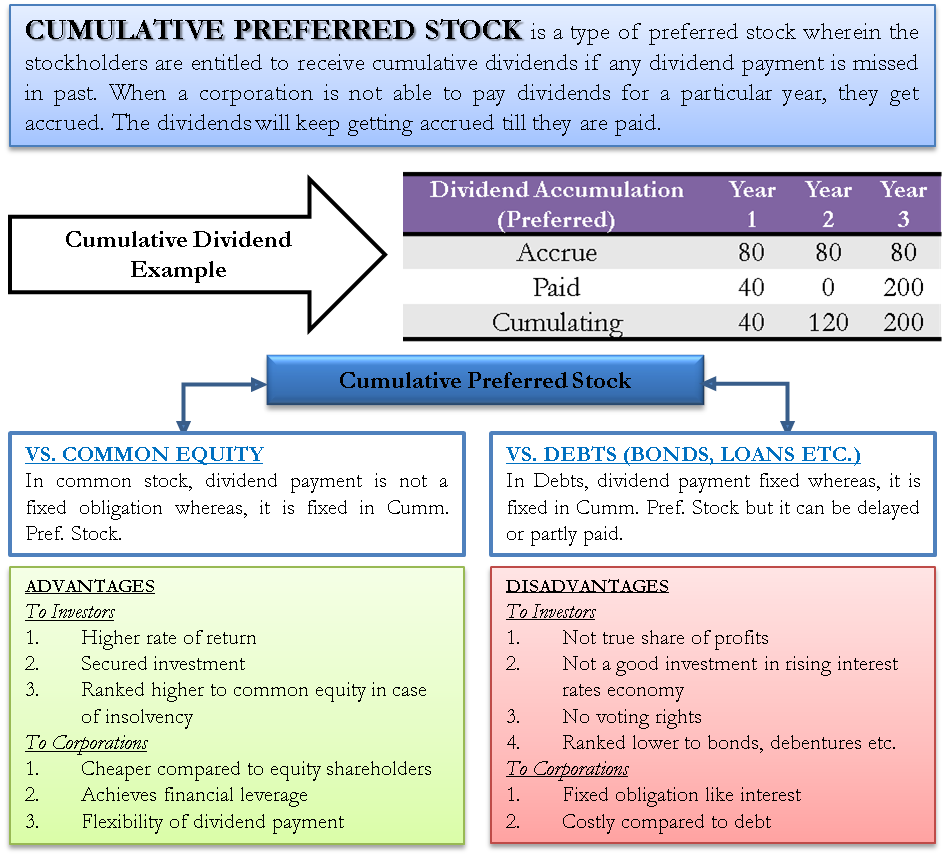

Cumulative preferred stock refers to shares that have a provision stating that if any dividends have been missed in the past they must be paid out to preferred shareholders first. The amount of the dividend is usually based on the par value of the stock. Any omitted dividends on cumulative preferred stock are referred to as dividends in arrears and must be disclosed in the notes to the financial statements.

Information and translations of cumulative preferred stock in the most comprehensive dictionary definitions resource on the web. In other words its a type of preferred stock that has a right to a specific amount of dividends each year. Preferred stock whose dividends accrue should the issuer not make timely dividend payments.

What does cumulative preferred stock mean. Most preferred stock is cumulative preferred stock. This preferred stock feature assures the owner that any omitted dividends on this stock will be made up before the common stockholders will receive a dividend.

Usually the issuing company cannot issue dividends to the holders of its common stock in the same year. Meaning of cumulative preferred stock. Preferred dividends must be paid before any dividends are paid to common shareholders.

Preference or preferred stock is called that because it carries a legal claim that is superior to common stock on the underlying earnings and assets of its issuer. Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock. Typically the corporations board of directors will not declare a dividend they will be omitting.

This means that shareholders do not have a claim on any of the dividends that were not paid out. That is all dividends that were skipped must be paid to cumulative preferred stockholders before any dividends are paid to common stock holders. This stock consists of a provision that demands the company to pay the shareholders all the dividends.

Cumulative preferred stock also called cumulative preference shares is a class of preferred stock whose dividends accumulate if they are not paid in any year and must be paid in future before any dividends are paid to common stockholders. Definition of Cumulative Preferred Stock. Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined.

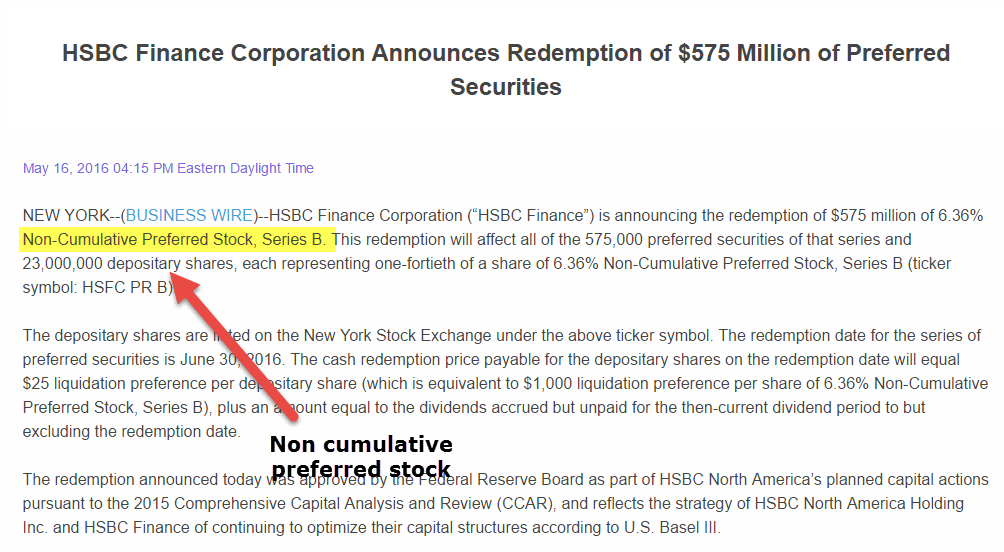

This contrasts with non-cumulative preferred stock for which stockholders must forgo dividend payments that are missed. Noncumulative preferred stock allows the issuing company to skip dividends and cancel the companys obligation to eventually pay those dividends. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative preferred shareholders.

Cumulative preferred stock stock whose dividends if omitted because of insufficient earnings or any other reason accumulate until paid out. That is all dividends that were skipped must be paid to cumulative preferred stockholders before any dividends are paid to common stock holders. Cumulative preferred stocks allow the accumulation of dividends until they are paid.

Cumulative preferred stock definition. Therefore the amount of these past omitted dividends that. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common stock.

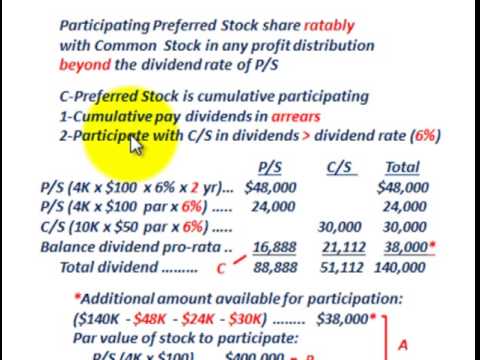

Preferred stock can be cumulative preferred stock where an investor is entitled to the current years dividends as well as all dividends in arrears or outstanding dividends from previous years. Participating preferred stock They are explained in detail below. Preferred stock for which the publicly-traded company must pay all dividends.

Thus a 5 dividend on preferred shares that have a 100 par value equates to a 5 dividend.

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Preferred Shares Meaning Examples Top 6 Types

What Is Preferred Stock 2022 Robinhood

Cumulative Preferred Stock Definition Business Example Advantages

Types Of Preference Shares Learn Accounting Accounting Principles Financial Literacy Lessons

Difference Between Cumulative And Non Cumulative Preferred Stocks

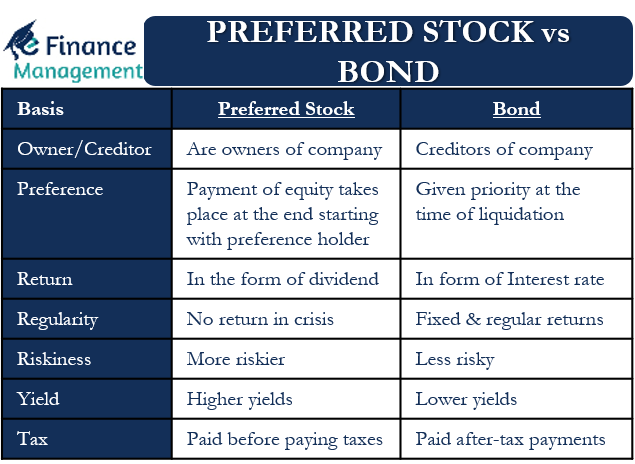

Preferred Stock Vs Bond Meaning Differences And More Efm

Cumulative Preferred Stock Define Example Benefits Disadvantages

What Is Preference Share Types Of Preference Shares Should I Buy

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Presentation On Shares Powerpoint Slides

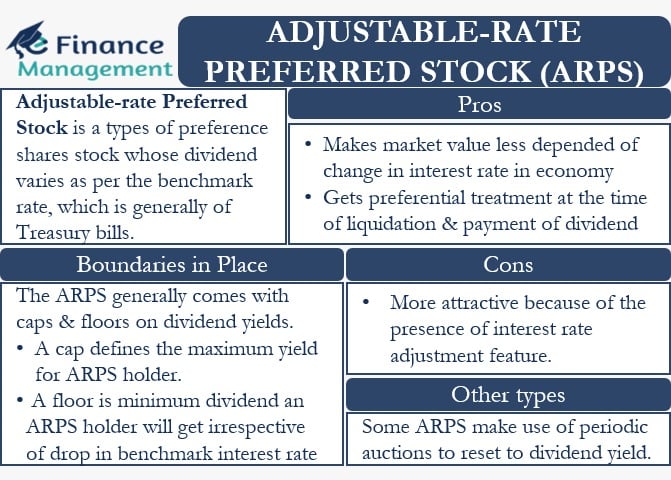

Adjustable Rate Preferred Stock Meaning Pros Cons And More

Preferred Shares Meaning Examples Top 6 Types

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Types Of Shares Online Presentation